Advertisement

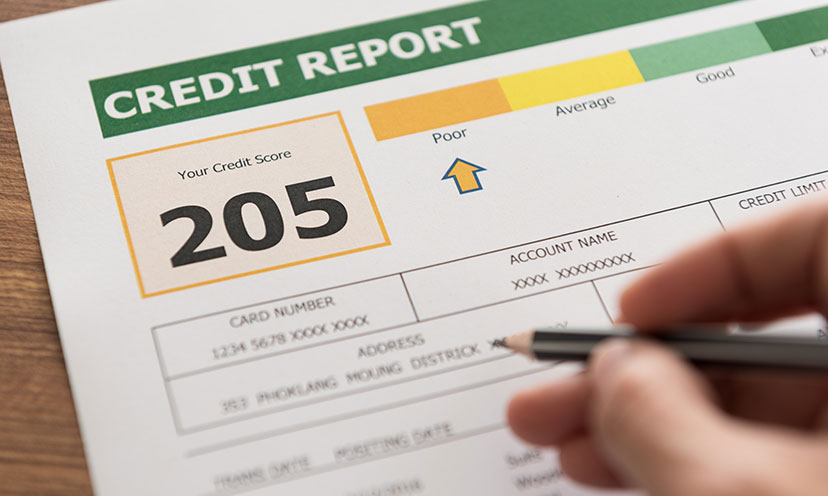

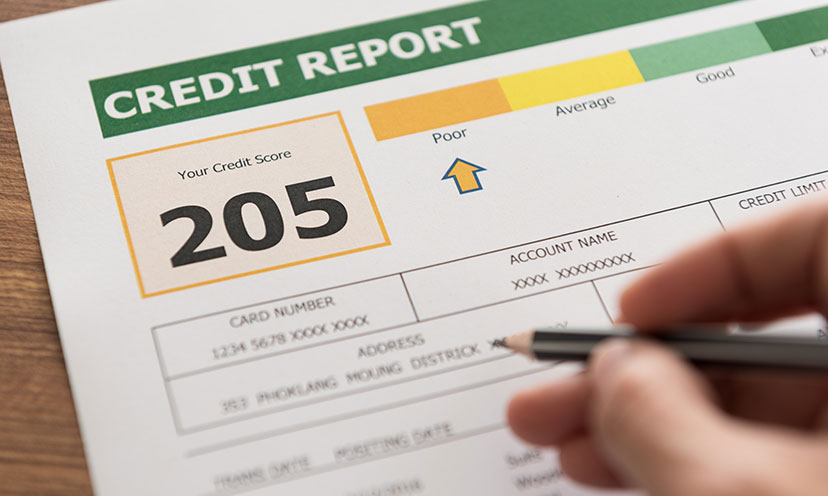

How Your Credit Score Impacts Every Aspect of Your Life

Blog | September 12th, 2018

Get It Free Recommends

Blog | September 12th, 2018