The Best Money App To Stick to Your Budget

The

You Need a Budget app is a relatively hands-off tool and helps you plan your spending for the upcoming month. You can link up your financial accounts with the tool. Then, the app will provide tips and recommendations for how you can spend your cash over the next month.

The app also allows you to track and create financial objectives as part of your budget. The app doesn’t passively list your spending and requires you to track finances more closely.

The Best Money App To Help You Save

The

money-saving app Trim is an amazing application that can help you cancel subscriptions and gain refunds for products that have decreased in price. The app can even show you which bills to negotiate. The Trim app will negotiate on your behalf with the phone company so that you don’t have to sit on hold for two hours.

All you need to do is connect your accounts to the app, and the tool will find areas to negotiate to reduce your rates. You can save as much as $620 per year by using the Trim app.

The Best Money App To Plan Your Finances for the Future

Dollarbird is one of the best money apps around, especially when planning for large expenses in the future. The money app will allow you to develop a calendar and track your spending. Here, you will add your past, present, and future financial transactions.

Essentially, you’ll get to see your expenses based on a monthly and yearly calendar. The money app can also help predict any major expenses that may occur in the future. With the app, you’ll have a better understanding of your financial standing.

Before You Go

Are there any other great tools besides these top three money apps? Well, you can also consider using the

Budget Boss app to make a budget, the

Ibotta app to cut your grocery spending, or the

Mint app to track your expenses.

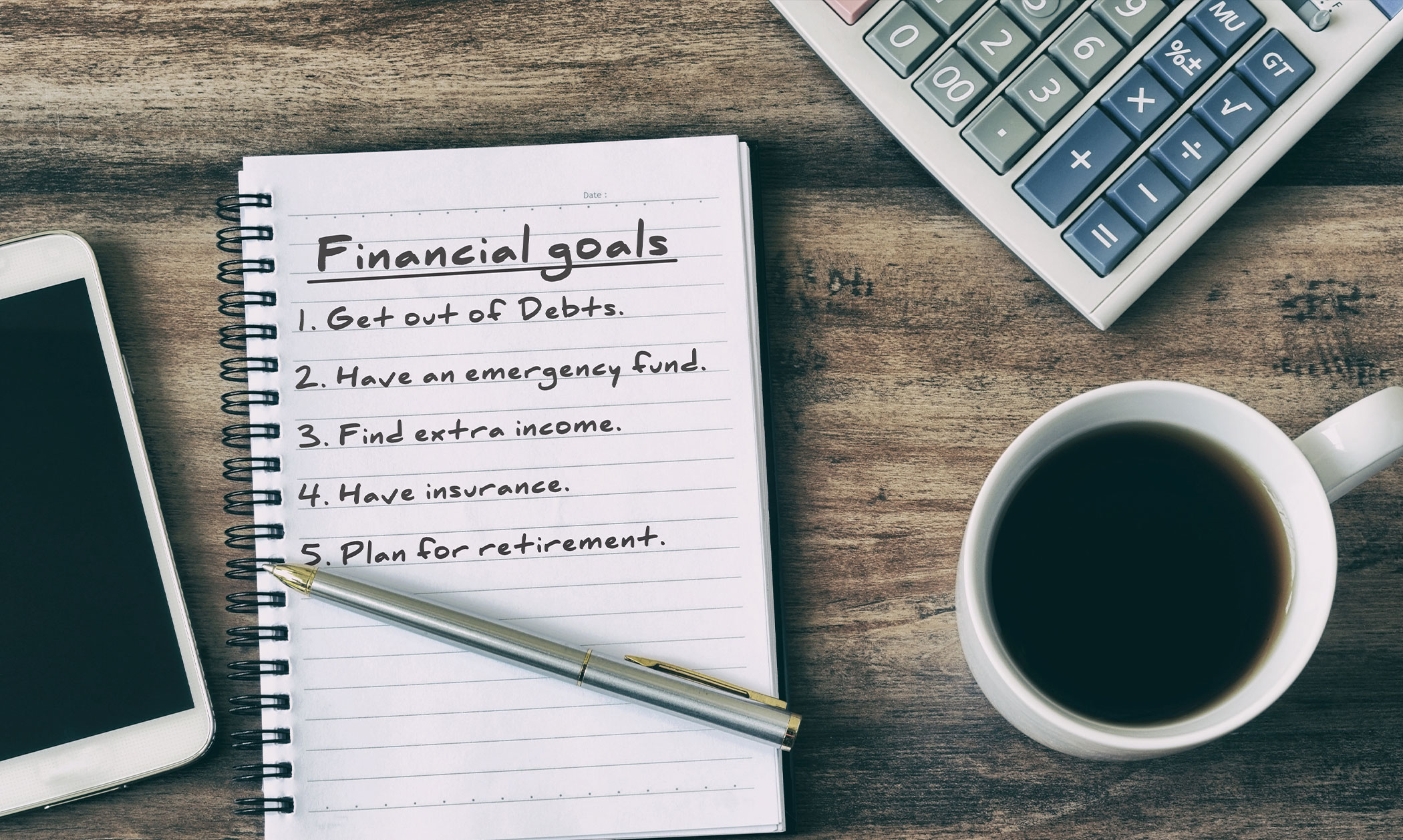

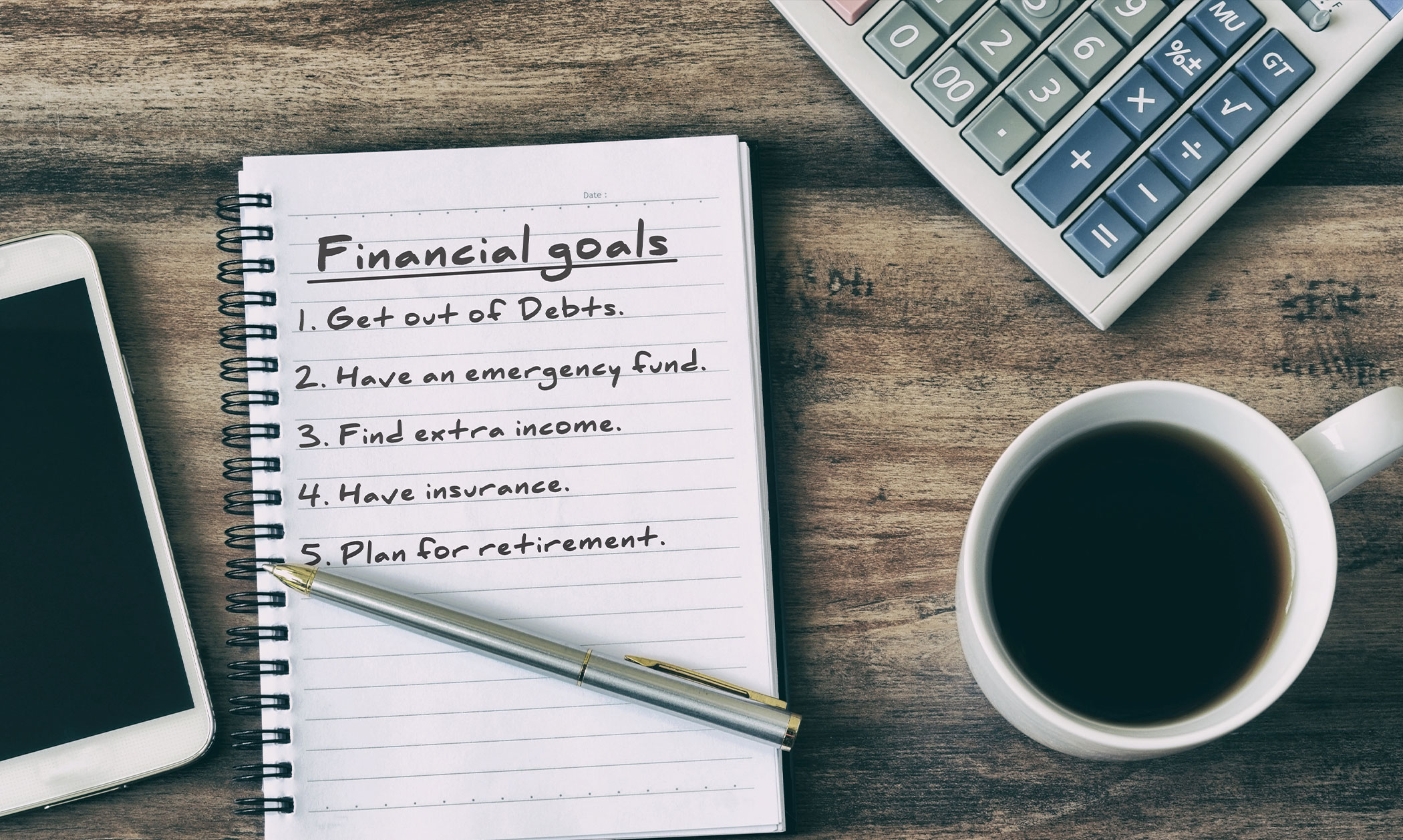

One way or another, you can meet your financial goals and save for the future with the help of these useful money apps.